Home / News / India News / Article /

Union Budget 2024: Booming inswingers, unexpected yorkers, and a key run-out

Updated On: 24 July, 2024 06:48 AM IST | Mumbai | Mitil Chokshi

As fin-min outlines strategic reform formula like a fine T20 chase, there are googlies galore for the middle-class and investors

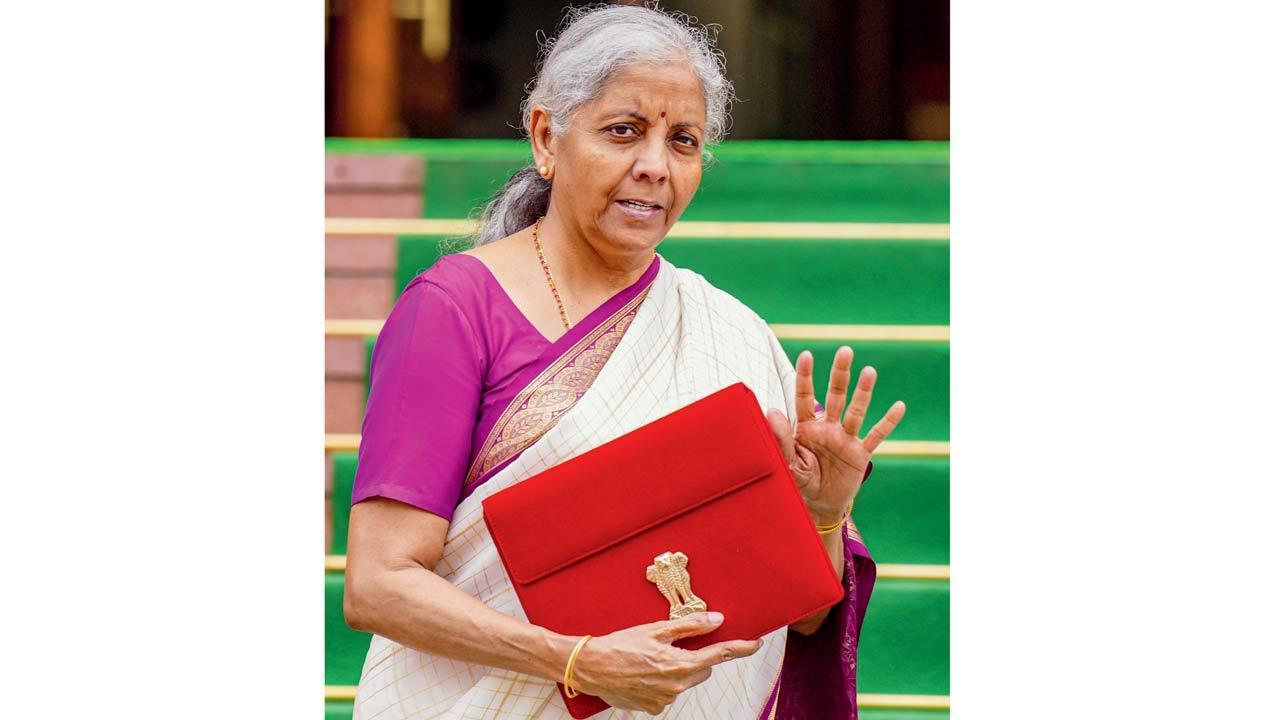

Union Finance Minister Nirmala Sitharaman

As the world eagerly awaits the Paris Olympics beginning on July 26, India is engaged in its own version of a global spectacle: a vision for 2047, which includes a dynamic overhaul of its tax landscape. The run-up resembles strategy in a World Cup cricket match. Just as players strategise power plays to secure victories, our finance ministers have implemented bold reforms aimed at reshaping India’s economic landscape. These reforms focus on promoting investment and domestic production, simplifying and rationalising tax processes, improving tax administration and litigation and ensuring tax fairness.

As the world eagerly awaits the Paris Olympics beginning on July 26, India is engaged in its own version of a global spectacle: a vision for 2047, which includes a dynamic overhaul of its tax landscape. The run-up resembles strategy in a World Cup cricket match. Just as players strategise power plays to secure victories, our finance ministers have implemented bold reforms aimed at reshaping India’s economic landscape. These reforms focus on promoting investment and domestic production, simplifying and rationalising tax processes, improving tax administration and litigation and ensuring tax fairness.

Much like calculated innings in cricket, the new tax regime is designed to benefit the salaried class and middle-income groups. The strategy includes changes to the tax slabs, an increase in the standard deduction from Rs 50,000 to Rs 75,000 aimed at lowering taxes, higher thresholds for tax liability leading to a tax saving of Rs 17,500 annually per employee, easier claiming of credit for TCS collected and TDS deducted, and optimised financial planning for millions of employees.