World Thrift Day: A beginner's guide to saving and investing in your 20s

Updated On: 11 January, 2023 09:27 PM IST | Mumbai | Sarasvati T

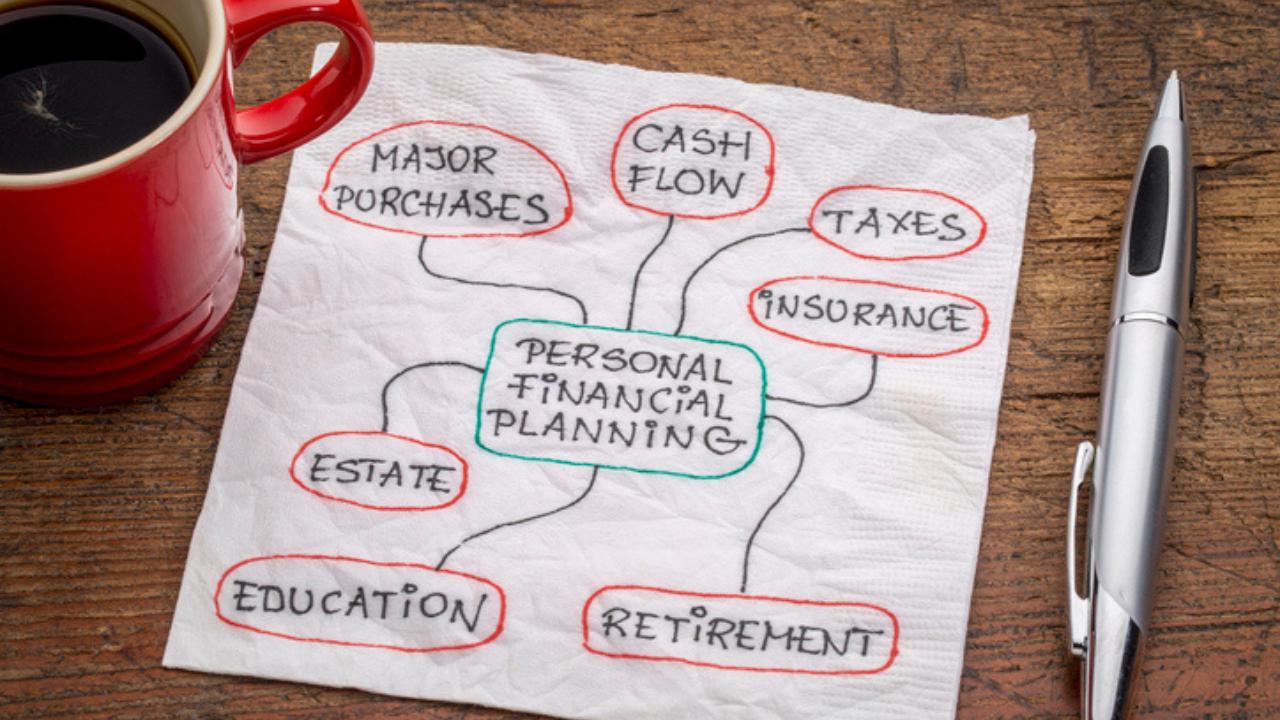

Managing monthly income and saving money is important for young adults, but many are puzzled about the process of it. Finance experts share a quick guide on budgeting, saving and investing during your early 20s

It is always useful to learn and practise managing money effectively early on; a crucial factor defining one’s financial independence. Image for representational purpose only. Photo Courtesy: iStock

“The decisions taken in early 20s often lay the basis of an individual’s financial planning and its benefits throughout their lifetime,” says Ajay Shah, director and head- retail, Care Health Insurance. “Effective early management of finances enables one to explore and experiment for future financial security and stability,” he adds.

Savings and investments often do not top the list of priorities for early career working individuals, who have just started “adult-ing” and are taking primary steps towards first managing their income. It is natural that they struggle spending money wisely initially, while not giving much thought to future financial emergencies as they live their day-to-day life. Depending on the caste and class privilege of an individual, the situations differ for many.

Buy now to read the full story.

For any queries please contact us: E-mail: support@mid-day.com